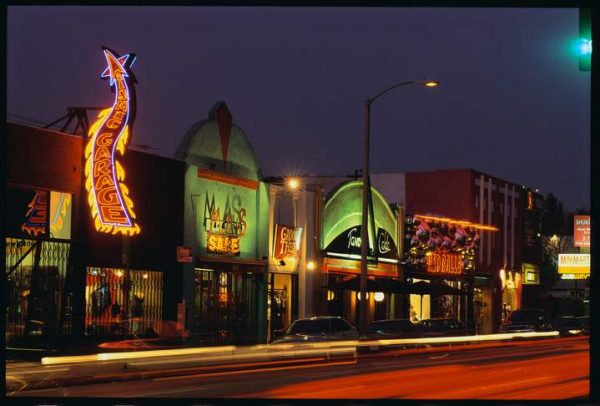

All of the legal American cannabis markets have experienced their periods of consolidations, company failures, and market stress, and this moment appears to be peak stress in California (so far anyway.) That means now is a unique moment for investors looking to grab distressed assets.

Canna Law Blog

- Many distressed-asset investors are looking to take a controlling interest in businesses they want to turn around or restructure. At the least, they seek to secure controlling authority through debt instruments.

- Nonetheless many will warn away from investing in cannabis companies because of the byzantine and water-logged state and local government oversight systems. Then, there are the state regulatory disclosure requirements. The author encourages an "open mind" to "vulture investing" here, "as there are many California cannabis businesses with few realistic options for continued survival without a serious infusion of capital."

Quick Hits

- February was a remarkably strong month for the Western cannabis states, with an 11% overall sales improvement in Cali and jumps as high as 37% in Arizona. BDS Analytics also reports that Nevada sales went up 16% compared with the previous February.

New Cannabis Ventures - As sales rise and dip, companies' first concerns must be measures to ensure employee or customer safety. But John Schroyer says California businesses must also keep in mind potential inaction from local government–or restrictions.

MJ Biz Daily - On a podcast call from Eureka, Papa & Barkley chief product officer Guy Rocourt explains why he's a Navy veteran who views selling weed as a patriotic act.

Cannabis Economy - The days of passing joints back and forth might be officially done. Do we really need to be sad about that?

brobible