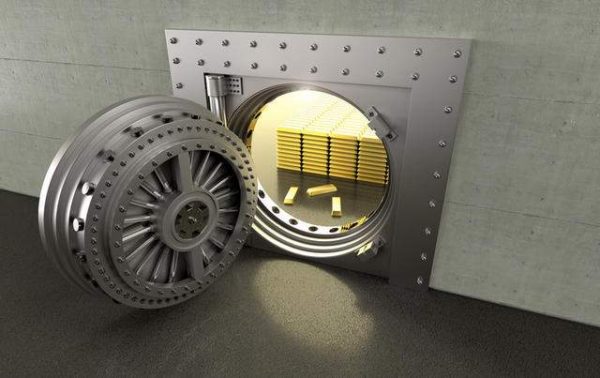

California dispensary Harborside secured a $12M revolving credit facility with an unnamed federally-regulated bank. It's apparently the first loan of its kind to a plant-touching business.

San Francisco Business Times

- “This deal is the culmination of months of effort and reflects the close working relationship and trust that we developed with our bank,” Harborside CFO Tom DiGiovanni said. He called the loan "transformational" for the company.

- The story says the loan is secured "by substantially all of the company's assets."

Separately, lawyers for the two men on trial for tricking banks into processing credit card payments for delivery app Eaze said banks including Citigroup and Bank of America were happy to look the other way. (Eaze has not been charged and has said it cooperated with authorities. Citigroup and Bank of America declined to comment to Bloomberg.)

Bloomberg