A story in MJBiz discusses the shake-up at California retailer Harborside after it went public and had to shed its activist roots. The situation has become common as cannabis companies with limited fundraising options started trading in Canada.

According to the story, the company took on a much more buttoned-up corporate culture and a number of staffers decided to part ways with the firm.

- “It just comes down to the fact that … all these companies, under normal circumstances, had no business going public,” said Jon DeCourcey, an analyst at New York-based Viridian Capital.

- “The DeAngelos [founder Steve and his brother Andrew, formerly Harborside’s COO] had raised money. They had shareholders, so they didn’t own 100% of the company. So they had a responsibility to their shareholders to bring in profit. So going public only exacerbated it from that end,” current board president Matt Hawkins, managing partner at Entourage Effect Capital said. “That’s just business. If people don’t understand that, then I don’t know what to say.”

- Steve and Andrew, who have cut their ties with Harborside, declined to comment for the story.

- Other companies cited as experiencing similar “turmoil” after going public include MedMen, Ayr Wellness and Medicine Man Technologies (now Schwazze.)

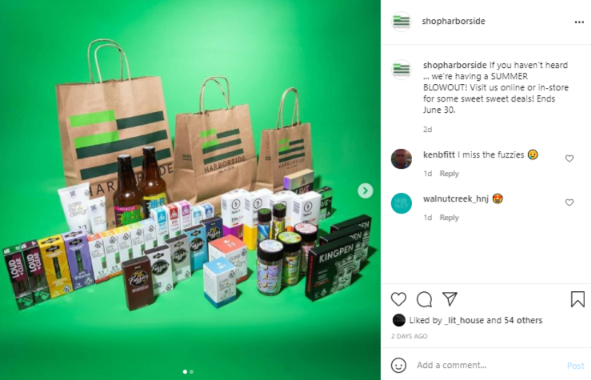

Oakland-based Harborside was one of the city’s first dispensaries. Founded by Steve DeAngelo, it’s famous for taking on the federal government in a forfeiture lawsuit it won and a less successful fight against industry-hated tax rule 280E.

East Bay Express, MJBiz

Quick Hit

- Bloomberg looks for lessons in California’s $100M weed biz bailout.